HOW TO AVOID TAX HEADACHES WHEN EMPLOYEES TRAVEL OUT OF TOWN ON BUSINESS

Business travel, an expensive and time-consuming activity for both the employer and employee, also can create tax problems for all concerned unless the rules are followed to the letter. If it’s done right, business travel will be fully deductible by the company (but only 50% of travel meals are deductible), tax-free to the employee, and […]

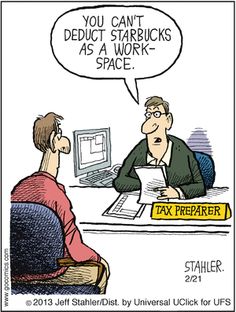

The 5 Biggest Tax Mistakes Small Business Owners Make

Owning your own business can be rewarding, but as most entrepreneurs know, it also means a lot of work, much more than a traditional salary-based job working for someone else. With all the responsibilities, a well-meaning business owner is still at risk of making a regrettable tax mistake. Whether a business is incorporated and files […]

The Top 5 Accounting Mistakes By Small Business Owners

Small business owners face numerous everyday challenges, and they usually conquer them with their entrepreneurial strength. Unfortunately, keeping the books on their growing business is not a skill someone can simply persevere through and get it right. The potential consequences of messing up on the accounting functions can be serious when it comes to the […]

Taking the Home Office Deduction for 2014

If you use your home for business, you may be able to deduct expenses for the business use of your home. If you qualify, you can claim the deduction whether you rent or own your home. If you qualify for the deduction you may use either the simplified method or the regular method to claim […]